IRS audit help wtih bank levies

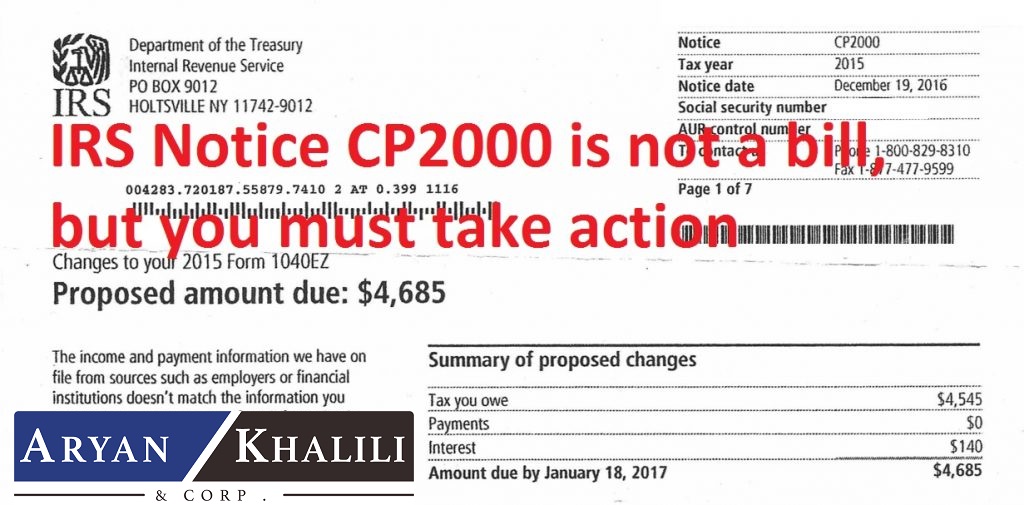

Since it may happen to you without any warning, you should always be ready. Nevertheless, as such things are quite harsh, the IRS will give you several warnings before issuing it. With this one, IRS levy your bank accounts in which they would take the number of funds they would need just so you would be able to lift from your tax debt. It is even possible for them to take all the money that you have in your bank account and so, you must act on it fast.

How does Bank Levy work?

Bank levies are surely a serious case as IRS can get your money overnight, regardless of whether you would be using it to pay your rent, buy food, medical bills, and other things. Also, the IRS has been permitted to do so. It’s fully legal as you were the one who failed your debt on time, especially 10 days after you’ve received a notification.

Apart from bank accounts, bank levies can also include the bank account of others as long as it has your name. You need to file a formal resolution immediately to keep your money safe. Typically, you only have a limited time of 21 days to act. After that, you can’t claim the funds that the IRS has gotten from your bank accounts.

How to stop them with our IRS audit help?

You should be able to protect yourself whenever such a situation arises or else. You would not even be able to enjoy spending your hard-earned money. Also, you should consider a bank levy as a wake-up call for you not to have tax debt anymore as you are already in that situation. All you need is to face it and get our help to solve it. There isn’t even a need for you to wait 21 days before you take any action.

To get rid of this, the best thing you can do is to seek help from an expert. It would be best for you to contact us as soon as you receive a notice. We have licensed professionals in Houston, TX, who are ready to help you with the IRS audit helps. No matter how complicated it is we can help. The sticky situation is our specialty. To get the best result by most effective means Contact Us for more info.